tax planning services introduction

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Tax planning strategy should be taken on the basis of existing provisions of the tax laws to achieve short term and long term benefits 2.

The word tax derived from the Latin word.

. Tax is the compulsory financial charge levy by the government on income commodity services activities or transaction. We have seen an ongoing approach to artificial tax avoidance which stands between avoidance and evasion. TAX PLANNING Tax Planning is an exercise undertaken to minimize tax liability through the best use of all available exemptions.

Tax planning is a series of. Its broker-dealer subsidiary Charles. Customizable services to fit your personal tax needs.

Tim Steffen senior consultant with PIMCO Advisor Education takes us through tax planning strategies for 2021 and beyond including the. Ad 5 Best Tax Relief Companies of 2022. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances.

An Introduction to Tax Planning Strategies. When it comes to delivering the return to our clients we often have the conversation with them about minimizing their tax liability for next year which seems to align. Tax planning is the analysis of a financial situation.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Gain a new skill while giving back to those who need it most. Morgan Advisor design an investment strategy for your needs.

An introduction to tax planning 1. The Charles Schwab Corporation provides a full range of brokerage banking and financial advisory services through its operating subsidiaries. Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years.

Tax planning is the legal process of arranging your affairs to minimise a tax liability. Our Expert Investment Professionals Focus To Maximize Returns And Strive To Manage Risk. Introdution Of Topic The Gst Or The Goods And Service Tax Is A Long Pending Indirect Tax Reform Which India H Research Paper Goods And Services Math Projects How.

Learn tax preparation while helping your community. A list of hallmarks of tax. When it comes to delivering the return to our clients we often have the conversation with them about minimizing their tax liability for next year which seems to align.

The purpose of tax planning is to ensure the tax efficiency and maximize your savings. Tax planning also includes thinking about how businesses should arrange their income and expenses each year to create a lower total tax bill for the business overall. View Our Strategies That Can Help Address Your Clients Tax Loss Harvesting Needs.

End Your Tax Nightmare Now. Tax planning is the essential part of Financial. Ad Committed to your success we provide big-firm knowledge with small-firm attention.

Ad Make Tax-Smart Investing Part of Your Tax Planning. The beauty of tax planning is while. We present the two most important objectives of tax research.

We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys. Connect With a Fidelity Advisor Today. It assists the taxpayers in properly planning their annual.

Ad Free price estimates for Accountants. Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. Using simple examples we show that taxation affects optimal investment decisions.

Ad Year-End Planning Resources To Help You Reallocate Capital For Tax Loss Harvesting. View Our Strategies That Can Help Address Your Clients Tax Loss Harvesting Needs. Ad Work one-on-one with a JP.

Explore a free investment check-up and see where you are on your path toward your goals. Tax Planning How To Plan Tax Services Income Tax Return Stripe Introduction To Sales Tax Vat And Gst Compliance Guide Indirect Tax Sales Tax Goods And Service Tax Taxes. Ad Volunteer with Tax-Aide.

Tax planning is effectively managing a taxpayers financial situation to minimize the tax burden at the federal and state level for both the near and long-term.

Tax Planning Strategies Tips Steps Resources For Planning Maryville Online

Tax Planning Vs Tax Preparation What S The Difference

Philadelphia Income Tax Preparation Planning For Individuals Business

Solution Introduction To Taxation Studypool

Wealth Management Personal Services

Calameo Importance Of Tax Planning Services

Manual For The Control Of International Tax Planning Inter American Center Of Tax Administrations

Introduction To Taxation Financial Advisers Investment Wealth Management And Pensions Advice Premium Financial Planning Services

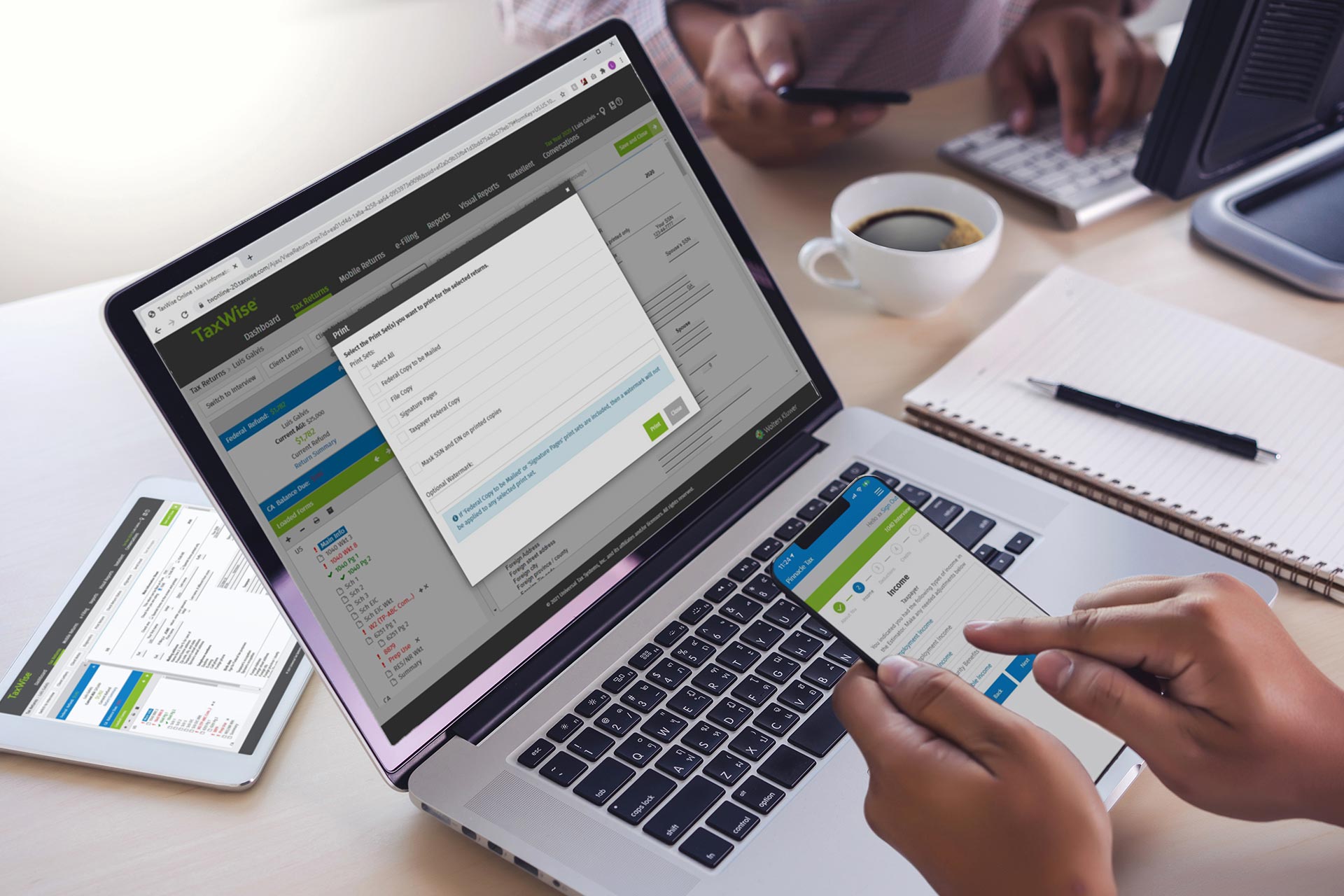

Taxwise Tax Preparation Software Wolters Kluwer

Solution Introduction To Tax Management And Tax Planning Studypool

2022 Taxes 8 Things To Know Now Charles Schwab

Solution Introduction To Tax Management And Tax Planning Studypool

Solution Introduction To Taxation Studypool

Rsm Tax Alert June 2013 Nr 25 Rsmi At

Income Tax Preparation Small Business Accounting Dartmouth Ma 508 496 7168

Tax Planning Compliance Services In Vermont Davis Hodgdon Cpas